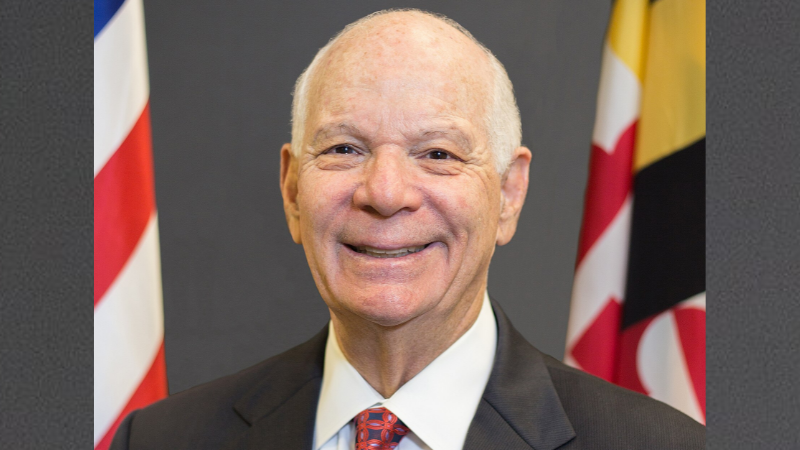

Ben Cardin | Ben Cardin wikipedia

Ben Cardin | Ben Cardin wikipedia

WASHINGTON – U.S. Senators Ben Cardin (D-Md.) and Shelley Moore Capito (R-W.Va.), along with Senators Tom Carper (D-Del.), John Boozman (R-Ark.) and Roger Wicker (R-Miss.) have introduced legislation to help modernize and increase safety at fraternity and sorority buildings nationwide. Their legislation would change the tax code to allow not-for-profit student groups to accept charitable donations to help construct new buildings or make safety improvements.

While colleges and universities can use charitable deductions to build and maintain student housing, the same has not been true for other not-for-profit groups. The Collegiate Housing and Infrastructure Act (CHIA) would change the tax code so tax-exempt charitable and educational organizations, such as national fraternities and sororities, could use tax-deductible charitable contributions to build, maintain or improve their not-for-profit student housing.

“This is about safety. Nearly half a million college students across the country live in not-for-profit student housing that were constructed prior to the widespread use of water sprinkler systems,” said Senator Cardin, a member of the Senate Finance Committee. “Our legislation will address this tax disparity and allow capital-strained not-for-profit student housing to install necessary safety equipment, expand housing and improve living conditions for students.”

“Sororities and Fraternities are a top provider of affordable student housing in West Virginia and across the country. The Collegiate Housing and Infrastructure Act (CHIA) would level the playing field for providers of student housing by allowing charitable donations towards housing infrastructure to be tax-deductible. I hope my colleagues will join me to help pass this bill that addresses critical safety concerns and the housing affordability crisis faced by college students,” Senator Capito said.

“It is up to us to ensure that college students have the appropriate housing resources they need. The U.S. tax code shouldn’t stand in the way of that,” said Senator Carper. “This bipartisan legislation will allow campus groups to directly fund housing improvements, such as installing safety measures and improving living conditions. With full access to use of their funding, students can feel comfortable in their housing.”

“Increasing safe, ample housing within college communities is good for students and carries wider economic benefits. By eliminating an arbitrary distinction in tax policy to help incentivize repairs, upgrades and new construction of nonprofit-sponsored housing, we can improve the quality of life on campuses in Arkansas and across the country. I’m pleased to join my colleagues on this bipartisan, common-sense legislation,” Senator Boozman said.

Alerts Sign-up

Alerts Sign-up