On July 13, U.S. Senators Chris Van Hollen (D-Md.), Mark R. Warner (D-Va.), Rev. Raphael Warnock (D-Ga.), Jon Ossoff (D-Ga.), and Tim Kaine (D-Va.) and U.S. Representative Emanuel Cleaver (D-Mo.) introduced bicameral legislation to help first-time, first-generation homebuyers – predominately Americans of color – build wealth much more rapidly. By offering new homeowners a 20-year mortgage for roughly the same monthly payment as a traditional 30-year loan, the LIFT Homebuyers Actwill allow individuals traditionally underrepresented in the housing market to grow equity twice as fast.

“Homeownership is a key tool for Americans to grow their wealth and build economic stability, but for far too many people, this goal remains out of reach. This is especially true for people of color – which is why we need to address the legacy of discrimination in our housing policy. This bill will help level the playing field for first-time, first-generation buyers and empower them to build more wealth,”said Sen. Van Hollen.

“Homeownership is one of the key ways Americans build capital and wealth. Unfortunately, racism and systemic discrimination in our housing lawshaveput this opportunity out of reach for far too many families of color,” said Sen. Warner. “The LIFT Act will help narrow the racial wealth gap by allowing qualified home buyers to build equity – and wealth – at twice the rate of a conventional 30-year mortgage.”

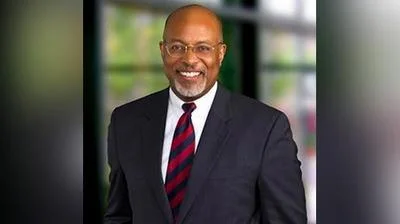

“It’s about time Congress took bold steps to support the American dream of homeownership for working class families that for too long have been left behind, which will not only allow more hardworking Americans to build generational wealth but also help close the racial wealth gap,” said Rep. Cleaver. “The LIFT Act builds upon President Biden’s economic agenda that focuses on building our economy from the bottom up and middle out, allowing more families to qualify for homeownership and build equity and stability in their home at an accelerated rate. As the Ranking Member of the Subcommittee on Housing and Insurance, I’m proud to introduce this legislation with Senator Warner and his colleagues in the Senate, as we seek to ensure every American has an opportunity to share in the prosperity of this great nation.”

“Housing is dignity and security for hardworking families in Georgia and across the nation, and owning a home is a long-held pathway to building generational wealth. But too many families have been left out of the American dream of buying a home, and Congress should act to make it a reality for more people,” said Sen. Reverend Warnock. “I’m proud to join my colleagues in reintroducing the LIFT Act to help put the dream of homeownership in reach for working families in Georgia and nationwide, boosting our economy and helping provide families safety and security. Let’s get this done.”

“This is about helping first-time homebuyers pay down their mortgages and build wealth in their homes more quickly. I'm teaming up with Senator Warner to help low-income Georgians and first-time homebuyers build generational wealth,” Sen. Ossoff said.

“Homeownership is not only a key part of the American dream but also one of the best ways to build generational wealth,” said Sen. Kaine, a former fair housing attorney. “I’m proud to be joining my colleagues in introducing this bill to help first-generation homebuyers, particularly those from communities of color, build wealth and help address the racial wealth gap in our country.”

First introduced in 2021,theLow-Income First Time Homebuyers (LIFT) Actwould establish a program at the Department of Housing and Urban Development (HUD), in consultation with the Department of the Treasury, to sponsor low fixed-rate 20-year mortgages for first-time, first-generation homebuyers who have incomes equal to or less than 120 percent of their area median income. Treasury would subsidize the interest rate and origination fees associated with these 20-year mortgages so that the monthly payment would be in line with a 30-year Federal Housing Administration (FHA)-insured mortgage.

For example: A first time homebuyer of modest means who purchases a property for $210,000 is likely to put down $10,000 and take out a $200,000 mortgage. In today’s market, a lender would offer this borrower a 6.5% 30-year FHA insured mortgage, for which the borrower would pay an annual 0.55% FHA insurance fee and a 1.75% up-front insurance fee, which would be folded into the mortgage. The borrower would have a monthly payment of $1,377. Under the LIFT program, the lender would instead offer this homebuyer a 5.5% 20-year FHA insured mortgage, which would include an up-front 4.00% FHA fee that would be folded into the loan and no annual FHA premium. The borrower would have a monthly payment of $1,430. By paying roughly the equivalent monthly payment, a borrower with a LIFT loan would build equity more than twice as fast.

By allowing borrowers to build equity through their homes at twice the rate of a comparable 30-year loan without meaningfully increasing the monthly payment, LIFT will improve the power of homeownership for millions of families. Coupled with well-targeted down-payment assistance, the LIFT program will make meaningful progress in narrowing the racial wealth gap, expanding and greatly strengthening the wealth-building benefits of homeownership in communities too long left behind by our existing financial structures.

A copy of the legislation is available here. A summary is available here.

Alerts Sign-up

Alerts Sign-up